Online Dating Application Market Forecast: Market Size to Reach USD 15.56 Billion by 2032 Driven by Revenue Generation, Regional Trends, and Digital Adoption | SNS Insider

The online dating application market is entering a new era of growth and innovation. Once seen as a digital novelty, online dating has now become a mainstream behavior across the globe, driven by a surge in digital adoption, changing social norms, and evolving user preferences.

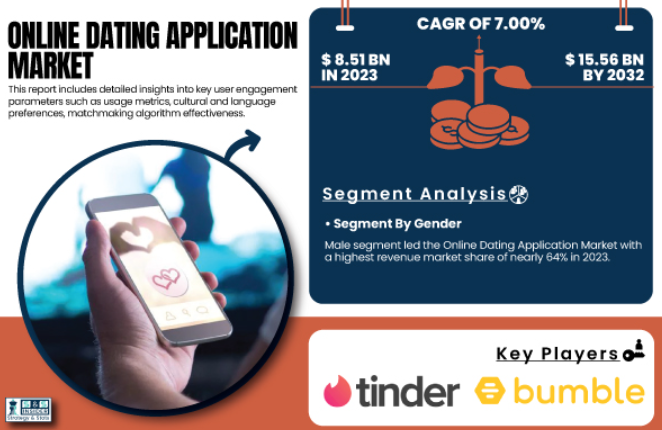

The industry was valued at USD 8.51 billion in 2023 and is expected to reach USD 15.56 billion by 2032, growing at a CAGR of 7.00. In this article, we dive deep into the most impactful trends, statistics, and strategic insights to help you understand what’s next in this dynamic market.

1. Online Dating App Market Size Doubles in a Decade

The online dating application market is showing robust expansion, with the global market size poised to reach USD 15.56 billion by 2032. This marks a significant increase from its valuation of USD 8.51 billion in 2023.

Key Market Metrics:

| Metric | Value |

| Market Size in 2023 | USD 8.51 Billion |

| Expected Market Size by 2032 | USD 15.56 Billion |

| CAGR (2024–2032) | 7.00% |

Growth is driven by:

- Smartphone adoption and internet access

- Shifting social norms and greater cultural acceptance

- Demand for customization and smarter matchmaking

2. Premium Features and Subscriptions Dominate Revenue Generation

The subscription segment dominated the online dating space in 2023, contributing more than 72% of the revenue share in 2023. Users are showing a willingness to pay for premium features, seeing subscriptions as investments in better experiences.

Top Monetized Features in 2025:

- Unlimited swipes

- Boost and spotlight visibility

- Read receipts and message prioritization

- Access to advanced filters (e.g., politics, religion)

- Profile verification badges

This model generates recurring revenue through tiered plans and pay-to-upgrade interactions.

3. The U.S. Leads, but Asia Pacific Will Grow at the Fastest CAGR

While the U.S. led the online dating application market with USD 2.33 billion in 2023, the Asia Pacific region is on track to grow at the fastest CAGR, supported by strong mobile infrastructure and urbanization.

Regional Forecast Comparison:

| Region | 2023 Market Size | 2032 Forecast | CAGR |

| U.S. | USD 2.33 Billion | USD 4.22 Billion | 6.83% |

| Asia Pacific | USD 1.72 Billion | USD 3.63 Billion | 8.78% |

| North America | Largest Market Share | Slower Growth | 6.5% Approx. |

Key Drivers in Asia Pacific:

- Rising smartphone usage

- Support for localized languages and cultures

- New user acquisition strategies targeting Gen Z

4. Rising Digital Adoption Reshapes Online Interaction

Thanks to rising digital behaviors and smartphone adoption, users expect fluid, fast, and secure dating experiences. The user base has become digitally fluent and expects:

User Expectations in 2025:

- Seamless mobile UI/UX

- Integrated safety and reporting tools

- Personalized suggestions using AI

- Cross-platform interaction across devices

These shifts have pushed dating apps to enhance personalization and reduce churn with smarter engagement loops.

5. Gen Z Dominates Usage and Revenue Metrics

The 18–25 years segment accounted for the highest revenue share in 2023, with high daily app usage, profile creation, and interaction across multiple platforms.

Why Gen Z Dominates:

- Early adopters of app culture

- Comfort with technology and digital intimacy

- Responsive to gamified experiences and swipe mechanics

- Strong tendency to use dating apps as part of social identity

They generate the most impressions and premium feature purchases, making them critical to growth forecasts.

6. AI-Based Matchmaking Enhances Accuracy

The integration of AI into dating apps has changed the game. Through machine learning, NLP, and sentiment analysis, AI-based systems now deliver smarter matchmaking and fraud detection.

AI Applications in Dating:

- Predictive match suggestions

- Scammer and bot identification

- Mood detection via message tone

- Personalized profile ranking

As a result, app developers are using accurate market signals to continuously refine experiences and improve outcomes.

7. Gender Segmentation Reflects New Dynamics

In 2023, the male segment accounted for 64% of revenue, but the female segment is growing at a CAGR of around 7.96%. Key reasons include:

Why the Female Segment Is Growing:

- Female-centric apps like Bumble, where women initiate

- Better security, moderation, and profile transparency

- A preference for values-driven experiences over casual dating

Balancing these segments will be key to long-term app success and user satisfaction.

8. Regional Strategies Must Consider Cultural Preferences

Success across different regions depends on local customization, pricing, and UI enhancement.

Winning Localization Strategies:

- Translation into native languages

- Inclusion of local dating customs

- Flexible pricing for varying disposable incomes

- Filters that reflect local social cues

Tailoring to regional and cultural acceptance norms increases uptake and retention.

9. Behavior Shifts Point to “Slow Dating” Trends

Apps are adapting to users’ desire for more meaningful interaction. As fatigue from casual swiping grows, new platforms are emerging that focus on:

Slow Dating Trends:

- In-depth profile questions

- Compatibility quizzes

- Time-gated message features

- Emphasis on values, not just appearance

These features also lead to higher time-on-app metrics and increased engagement—a boon for monetization.

10. Emerging Technologies Will Define Next-Gen Apps

Beyond AI, technology such as AR, VR, and blockchain is being explored to enhance user confidence and intimacy.

Tech on the Horizon:

- Virtual dates using AR avatars

- NFT-based identity verification

- Blockchain-backed data ownership

- Mood-matching through wearable integrations

Innovation and early adoption of these tools will help dating apps gain dominance in the coming decade.

11. Smart Monetization and Personalization = Market Leaders

The winners in this market will be the platforms that balance user privacy, personalized UX, and creative monetization models.

Top Monetization Models:

| Model Type | Description |

| Tiered Subscriptions | Multiple levels with increasing feature access |

| Microtransactions | One-off boosts and unlockables |

| Advertising | Programmatic ads targeted via AI |

| Affiliate Sales | Branded partnerships with lifestyle brands |

This multi-pronged approach will maximize revenue generation while improving long-term engagement.

Conclusion: Online Dating Apps Will Continue to Expand Globally

As the online dating application market continues to expand, driven by behavioral shifts, tech adoption, and innovative monetization, it presents significant opportunities. With a forecast to reach USD 15.56 billion by 2032, the race is on for brands to deliver not just matches but deeply customized, meaningful digital relationships.

Apps that invest in technology, prioritize user base diversity, and understand the dynamics of dating across regions will lead this revolution, one swipe at a time.