Since its initial public offering in February of this year, Bumble has been one of the most talked-about stocks with many people picking it as a great option to invest in. Recently, the company disclosed its third-quarter financial results. The results were largely positive particularly for the self-branded app; however, investors reacted with concern, seemingly focusing on some negative results for the company’s Badoo app.

Looking at Bumble Numbers

Perhaps the most significant takeaways from Bumble’s third-quarter financial results come from total revenue and average revenue per paid user. Both of these metrics saw significant growth from the third quarter of last year. In fact, total revenue yielded a 24% increase to $200.5 million. Revenue for the Bumble app saw impressive growth specifically, up 39% to $142.5 million and continuing to serve as the company’s primary revenue stream. However, all other sources of revenue saw a decrease by 3%.

Meanwhile, the average revenue per paying user also increased. This metric rose from $19.38 during the third quarter of 2020 to $22.97 this year, representing a growth of 18.5%. This is a particularly important measure as it indicates how profitable individual paying customers are. This shows that Bumble has succeeded in finding ways to better leverage paying users to contribute to the company’s bottom line.

Bumble also saw slight growth in adjusted EBITDA, with this measure rising from $53.7 million to $54.5 million. While this represented a very slight increase, it was impressive considering that analysts predicted a decline to $49.6 million. Thus, Bumble has once again beat projections by Wall Street analysts.

Despite these positive growth rates, Bumble is still operating at a net loss; however, even this figure is shrinking. The quarter saw a net loss of $10.7 million, representing a net loss margin of 5.3%. This was much less than the 2020 third-quarter net loss of $22.8 million, representing a margin of 14.1%. Overall, these strong results serve to provide a positive outlook on future performance for the company.

New Bumble Features

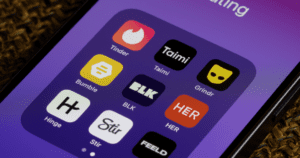

During this quarter, Bumble’s total paying users increased to 2.9 million as the app continues to be incredibly popular, increasing the proportion of the company’s revenue that it is responsible for. In order to keep the app engaging, Bumble continues to develop new features in an attempt to distinguish it from competitors, one of the factors that Bumble leadership cites as a reason for the continued growth of users and improved earnings.

A major feature rolled out during the recent quarter was the Night In feature, which allowed two people who had matched to play interactive games while engaging in a video chat. This feature serves as a way to help two people get to know one another in a more comfortable setting prior to meeting in person. This can be seen both as an innovative new aspect to online dating as well as a step on the part of Bumble to continue working to improve the safety of online dating.

While Night In was the major feature rolled out during this quarter, there were also a handful of other additions to the app. One was video notes, which complements the existing audio notes. This allows users to send short videos to one another, better facilitating communication and interaction options. The app also introduced a variety of lenses (think Snapchat) and the ability for 360-degree video backgrounds.

Investor Hesitancy

While the news for Bumble was largely positive, there was a bit of news that seemed to concern investors, resulting in a decrease in Bumble’s stock price. Valued at $47.75 before releasing third-quarter results, the company’s stock tumbled to $38.56 the day after the news broke and sat at $36.38 as of Friday, November 19.

The concerns from investors centered not around the self-branded Bumble app but upon the company’s Badoo app. Badoo accounts for roughly a quarter of the company’s revenue. Badoo is a social network app that focuses on dating. While not very popular in the United States, Badoo is quite popular in Europe. In fact, it ranks as the top dating app in France, Italy, and Spain.

Unfortunately, Badoo seems to be suffering from the fact that its popularity is largely in areas where the pandemic is still presenting significant challenges to business. Specifically, France and Italy were areas where use of the app was cited as declining with the belief that the languishing of the COVID-19 pandemic was contributing to lesser engagement and decreases in revenue.

Final Thoughts

While Bumble’s third-quarter results are largely positive, there is concern regarding the reception of Badoo in some markets. The declining revenue generated from Badoo – which represents a quarter of the company’s earnings – seemed to concern investors. As a result, Bumble’s stock declined following the release of third-quarter results and has remained in the mid-to-high $30’s since. However, overall financial metrics are positive, so expect Bumble to have more positive growth in the future.